Contents:

- Top 5 International Bitcoin Brokers

- The most important Facts in brief

- How to proceed

- Bitcoin share price development

- Bitcoin Brokers & Exchanges

- Where to Buy & sell Bitcoins?

- Bitcoin Marketplace

- Bitcoin Exchanges

- Buy & sell Bitcoins locally or regionally

- Identity card required by all mentioned providers

- Buy Bitcoins Anonymously

- Trading at Bitcoin CFD Brokers

- Trading cryptocurrencies

- Current Developments

- Advantages of Cryptocurrency

- Disadvantages of Cryptocurrency

- Current Bitcoin Price

Top 5 International Bitcoin Brokers

| Broker | Cost | Features |

|---|---|---|

| Markets.com |

|

|

| eToro |

|

|

| 24Option |

|

|

| Plus500 |

|

|

| Binance |

|

|

The most important Facts in brief

Bitcoins and cryptocurrencies in general are highly speculative instruments. What is the true value behind the current price that goes up and down? Is it all just a bubble or is there actually a market for Bitcoins?

Don’t let the itinerant preachers take you by surprise or convince you. Cryptocurrencies are highly speculative and still in their infancy. Many free riders take advantage of the ignorance and place fraudulent offers.

The financial market supervision and other authorities warn of so some enterprises and also of cryptocurrencies in general.

If you really want to put your money into cryptocurrencies, make sure that it is a legal platform.

How to proceed

- Be critical and skeptical with cryptocurrencies. Do not let yourself be lulled in and be aware that this is a highly speculative form of investment, which is repeatedly criticized by authorities (and no, the authorities do not see your skins floating away).

- If you really want to put money into cryptocurrencies, make sure that it is an amount that does not hurt when it is no longer available.

- Choose secure Bitcoin brokers and marketplaces, secure wallets (this is where the cryptocurrency is located and can of course be robbed).

- Start at best with low amounts and get a feeling for the world of cryptocurrencies and the constant up and down!

cryptocurrencies contain high dangers, therefore at best a small part of the money in addition use, which is easily to get over with a total loss! The dream of becoming rich fast, cannot be fulfilled also with cryptocurrencies.

Bitcoin share price development

Bitcoins arrived now in the middle of the society, at least in the perception of many Austrians, because it is reported constantly on the most famous cryptocurrency. The main reason is probably the fact that the rates of the various currencies have worked themselves explosively upward and one record followed the other. A look at the exchange rate development of the last years shows more than well, how strongly the course rose and there are naturally again and again setbacks, but in the long-term process the course went so far always further upward.

Bitcoins arrived now in the middle of the society, at least in the perception of many Austrians, because it is reported constantly on the most famous cryptocurrency. The main reason is probably the fact that the rates of the various currencies have worked themselves explosively upward and one record followed the other. A look at the exchange rate development of the last years shows more than well, how strongly the course rose and there are naturally again and again setbacks, but in the long-term process the course went so far always further upward.

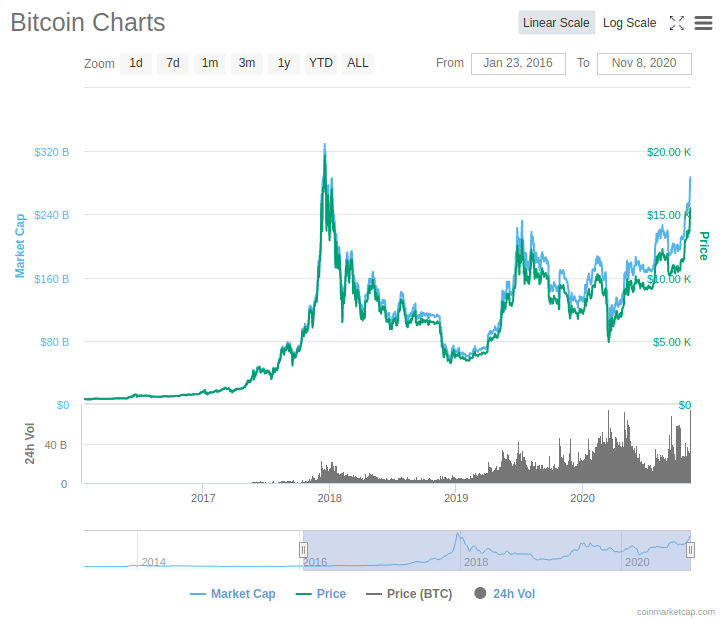

Here is the Bitcoin Chart, which shows the price development of Bitcoin in US dollars over the last years:

But as we all know, the past is really the past and there is no guarantee and certainty that things will continue to go up in the future. If one continues to speculate on rising prices, then one can buy Bitcoins, how that goes, the following chapter shows. If one would like to speculate on the price and here even speculate on falling prices, structured products are probably the goal. This chapter shows how trading with cryptocurrencies can work.

At the end of June 2019, the price for 1 Bitcoin in US dollars is over 11,500! At the beginning of June 2019, the price for 1 Bitcoin was still just over 8,000 US dollars. However, from summer 2019 on, the price went down again, and at the change from 2019 to 2020, the price was even below 7,000 US dollars again. Now, at the beginning of January 2020, the price was already back at over 8,000 US dollars. And now, in November 2020, Bitcoin is heading straight towards the all-time-high, as we’re already again above 15,000 USD.

Bitcoin Brokers & Exchanges

Where to Buy & sell Bitcoins?

How do you get cryptocurrencies? There are various ways to buy or sell cryptocurrencies like Bitcoins. The most important is the digital wallet, a wallet. Many offerers have their own Wallet and thus one gets this equal with. The Wallet is similar to a current account. It has a unique address, which is comparable to an account number. Bitcoins can be sent or transferred to this address.

Bitcoins buy & sell:

Who would like to buy Bitcoins or other cryptocurrencies in Austria has here for example the Graz enterprise Coinfinity or the Viennese enterprise Coinimal at the disposal. Coinfinity has for it a platform of the same name, Coinimal goes with the platform Bitpanda to the start. However, the costs here are a little higher than the costs or fees of the international stock exchanges, whereby Bitpanda became significantly more attractive compared to its competitor Coinfinity with a major update in May 2018.

Both companies are from Austria in comparison to the competition, which is certainly a reason for some crypto fans. Why should you buy & sell Austrian? It has the advantage that these enterprises are also seizable and with a digital cryptocurrency this can release a good feeling, besides one supports here also a domestic enterprise (whereby that is naturally no warranty on anything that an enterprise is registered in Austria):

- Coinfinity (here one must identify oneself immediately)

Purchase fee: 1,5 % + mining fee (but this fee is very low, as of 26.8.2018 it amounts to 0.00001000)

Sales fee: 1,5 %. - Bitpanda (faster registration and getting to know each other possible, identification only possible later)

Purchase fee: 1,49 %.

Sales fee: 1,29 %.

Bitcoin Marketplace

Bitcoins are often sold on a marketplace. The larger market places are mostly English-speaking.

Paxful.com

Marketplace fee: 1% seller fee plus possible further fees

Marketplaces like Paxful.com finance themselves over a small fee which you collect with each transaction. With Bitcoin this is for example 1 per cent.

Bitcoin Exchanges

If you would like to know where you can buy Bitcoins as an Austrian, there is the possibility to buy Bitcoins at a Bitcoin exchange. Well-known exchanges are e.g.

- Coinbase (8 € opening bonus for you and me with this friend recommendation link after deposit of 100 € and more)

Purchase fee: 1,49 %.

Sales fee: 1,49 %. - Bitstamp

from 0.10 to 0.25% depending on the trading volume in the last 30 days - Kraken

Purchase fee: 0,26 %

Sales fee: 0.16 %.

Coinbase is a giant trading platform from the USA, which was founded in 2012 and through which Bitcoin, Ethereum, Litcoin and Bitcoin Cash can be traded. As an Austrian, you can load credit balances very cheaply by bank transfer to a bank account in Estonia via SEPA transfer. According to the company itself, it already has over 10 million customers.

The Kraken or Bitstamp platforms are well-known and renowned trading platforms for Bitcoins and Bitcoin trading in euros can also be operated there.

Buy & sell Bitcoins locally or regionally

You can also buy or exchange Bitcoins locally. For example, there is an Android app called Mycellium Wallet, which has an integrated function called LocalTrader. With this function, you can find other Bitcoin traders in your area and meet them to trade. With Localbitcoins you can do the same thing on a web basis only. You don’t need an Android smartphone with the app to do so, making it more platform independent and practical.

Identity card required by all mentioned providers

Anonymity does not work with all these providers. You have to prove your identity with an official photo identification and so the purchase is no longer anonymous.

Who buys Bitcoins or other cryptocurrencies as Investment, then there are in addition, probably no real reasons, why one is to buy Bitcoins anonymously and resists a legitimacy. Who however nevertheless, for whatever reasons, would like to buy Bitcoins anonymously, has also for it possibilities. Which these are, read now:

Buy Bitcoins Anonymously

In Austria, Bitcoins can be purchased anonymously via Bitcoinbon.at but also redeemed. There are over 3,000 Bitcoin sales outlets (tobacconists) in Austria where this receipt can be bought. The purchase of Bitcoinbons is as uncomplicated as the purchase of a Paysafecard.

The denomination of the Bitcoins is divided into 25, 50 and 100 euros, and when you buy one you receive a coupon with a code. With this code, the buyer of the Bitcoin receipt then goes to the website and can redeem the coupon once (or the buyer can pass the receipt or code on to others and a third person can redeem the receipt on the website).

However, further details must be provided in addition to the code, such as a Bitcoin receiving address. How much you receive for the respective Euro equivalent depends on the current Bitcoin exchange rate.

But please note: The coupon is not valid indefinitely, but only 12 months. After that the coupon expires, so redeem it in time, otherwise it is over! And the fees? They are not low, because they are 9%. Not straight little, but that seems to be now probably the price for it to be able to buy anonymously Bitcoins.

Trading at Bitcoin CFD Brokers

CAUTION: Trading CFDs may not be suitable for you. Remember that CFDs are a leveraged product and can result in the loss of all your capital. Please ensure that you fully understand the risks involved. In addition, cryptocurrencies are highly speculative and strong price changes are not uncommon! Also read our article about Bitcoin margin trading.

Trading cryptocurrencies – not really recommended!

General note: The trading platforms are very intuitive and simple and invite you to transfer money and start trading. As easy as the start is, it is really hard to get out of it. It requires specialist and trading knowledge to be able to use these powerful tools and to trade successfully in the long term. It can happen much too fast that the deposited capital is gone and you are stopped. So in this sense, watch out also when trading with Bitcoin & Co and inform yourself carefully. In addition to a real account, the providers also have your demo account, where you can try out your system or idea without anything happening. https://www.marginbull.com is a website that aims to inform and educate people before they risk their hard earned capital.

There are some traders like eToro or Plus500 who promise the blue from the sky and make the entrance into trading cryptocurrencies really very easy, but you have to keep in mind that cryptocurrencies are highly speculative and probably only a few actually make a profit from trading – most traders will probably lose their money here. For this reason no further trading possibilities are listed here, because if you really want to deal with trading of highly speculative products, you should prepare yourself extensively over days, weeks or months and not click-click to open an account and go straight to ruin. Meanwhile, these companies must also indicate what percentage of private traders lose money there. As of June 2019 eToro and Plus500 provide the following data:

- Plus500: 76.4% of retail investor accounts lose money when trading CFDs with this provider

- eToro: 75% of retail investor accounts lose money when trading CFDs with this provider

All right, right? Don’t be tempted by the oh so great advertising promises! There is a very high probability that you will lose money as a retail investor. In the case of Plus500 just about 80% of all and with eToro still 2 out of 3 retail investors.

Current Developments

Up to the turn of the year to 2018 the world of cryptocurrencies was still in order, after that it went downhill properly in the course of the year 2018. In 2019 it went slightly up again and now, in 2020, new highs are back. The highs of 2017 and 2018 have not yet been reached, but things are looking up.

Up to the turn of the year to 2018 the world of cryptocurrencies was still in order, after that it went downhill properly in the course of the year 2018. In 2019 it went slightly up again and now, in 2020, new highs are back. The highs of 2017 and 2018 have not yet been reached, but things are looking up.

Since August 2020, Bitcoin is again constantly above 12,000 US dollars or over 10,000 euros. This means that Bitcoin and other cryptocurrencies are once again flying high. It can probably be stated that precious metals such as gold and silver are the crisis currency for the older ones, while for younger ones the cryptocurrencies are the safe haven.

There are constantly new financial services coming up for cryptocurrencies, such as savings accounts to earn interest on crypto holdings or things like loan products where customers can decide between lending cryptocurrencies to others to earn interest or to borrow coins. It is never recommended to get a loan for crypto trading – this has to be mentioned because many young traders try to borrow money for trading in order to trade with money they can definitely not afford to lose. Check out https://www.bitcoinloansites.com/ if you’re interested to give or take a loan (for reasonable and responsible purposes).

Advantages and Disadvantages of Cryptocurrency

Advantages

- No bank necessary

- Easy to store

- Fast payment processing

- Low transaction fees

- Perfect for small and smallest amounts

- P2P transfers possible (person-to-person)

- Safely transportable

- No central administration, independent currency

- Decentralized & democratic

Disadvantages

- Low acceptance by the general population or not known at all

- The software, especially for other cryptocurrencies, is still under development

- Some danger of deflation, since Bitcoins are usually only hoarded in the wallet and not put into circulation

- How do nation states deal with Bitcoins? What is the legislation? Bitcoins have a touch of underground currency and nation states want to put it there.

The advantages and disadvantages apply generally to cryptocurrencies and not only specifically to Bitcoin, the most famous representative from the world of cryptos.

Current Bitcoin Exchange Rate

As you can see from the development of the Bitcoin exchange rate, Bitcoin is a highly speculative currency. It is an up and down. Permanently. cryptocurrencies are very speculative and since Bitcoin is probably the most famous cryptocurrency, the speculative, volatile reservation also applies here. Note that Bitcoins should at best have an admixture to an asset portfolio, because they have a high-risk character!

Other important cryptocurrencies besides Bitcoin with the current exchange rates of

- Ethereum

- Litecoin

- Dash